Have you ever wondered how you get covered for the risk worth more than the premium you paid for your insurance company? And how insurance companies make money on it.

Well, that is pretty odd. But we never think about that, Why ? because someone said so, so we do it.

It happens for all of us, including me. We always forget to ask how and why and just follow the herd.

May be we are programmed that way!!

A little how and why in your life will make you think in a different perspective.

Yes, like gambling, insurance companies take a bet from you, that you won’t make any claims.

That claims maybe like you won’t make an accident, or you won’t falls ill and get hospitalized or you won’t die before retirement.

There are different kinds of bet , we categories as

Every one takes health insurance because it is good for us to be in a safer side, you dont know when what happens.

Consider you are working in a corporate company of 100 people, and the company pays your health insurance premium part of your salary package.

An employee pays Rs 10000 a year which covers him and his two dependents for 3 lakhs, higher the post higher the package value and premium.

So averagely each employees pay Rs 10,000 a year.

That calculates to Rs 10,00,000 a year totally.

So yearly the insurance companies collects 10 lakhs as their premium on a group insurance.

Here , the insurance companies takes bet of 10 lakhs from 100 members that they wont fall ill for a year.

So in one year how many of you or your kin will get hospitalized in that year. No one willfully gets hurt and get hospitalized. Accidents yes, it can happen but what is the probability ?

This where the insurance company makes money by betting on your risk.

Each risk is evaluated before making the terms and conditions and setting the premium. This is done by the underwriting experts. Who is educated to evaluate your risk and calculate how much premium you have to pay for the risk they bet on you. The bet they win on these terms are called underwriting profits

Sometimes there are instances where insurance companies hold your claim settlements for reasons unknown . Deferring claims will add to their profit.

If you have noticed young people have a lower premium value for insurance and older ones have a higher value. If you are above 60 getting health insurance is never an option. Because insurance companies don’t want to take a bet where they would lose. The probability of falling ill is more as you age more.

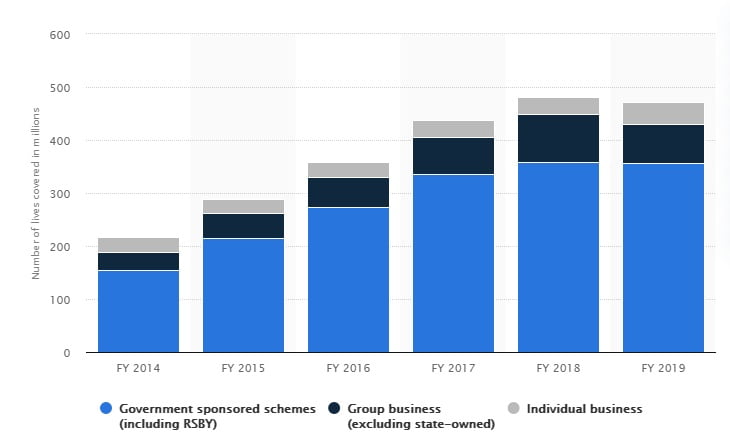

Image Source : Statista

If you see the above graph, the number of people availing health insurance is on the increasing trend. Nowadays it became a mandatory expense in our life, which we don’t want to risk.

Nowadays, there are fewer underwriting profits considering the claim settlements are more. So the insurance companies are now diverting their funds ( premiums) to other investment opportunities like bonds and others private investments.

There is a considerable time available for the insurance company between the collections of premiums and claim settlement, in which they divert the funds to investments that have favorable returns.

Some times long term insurance plans earn from defaulters who quit paying their insurance premiums in halfway.

Signing up for the wrong insurance paves the way for insurance companies to make money.

And there is some insurance you should take and you should take as early as possible, like life insurance. The early you take the lower the premiums are. And if you win the bet of not dying early you will get a lump sum amount, I see life insurance as an investment.

There is another insurance which I advise you to take note of, like auto insurance. Which government has made mandatory? But take it as a minimum unless you are a fan of GTA or pyscho who drives rashly.

Many of us are paying auto insurance which we don’t claim at all and get a ” No claim ” bonus all the time.

But taking the right insurance also shares your risk, like a pilot insuring for his life, and marine operators ensuring for their ship. So more the risk it is better to share the risk with insurance. Here the insurance companies may take higher premiums and make less money

Insurance companies normally lure you into high cover and claims for lower premiums, well its a sign of scam with a bogus company name. They mostly target senior citizens giving unrealistic packages. I remember once my father received a call from a company called Acess 2 Healthcare giving a package for 6 family members for Rs 9980. That package had a free consultation, free checkup also free add on like motor insurance and whatnot.

However, a little google search on it was all needed to identify that it dint have a proper office address and nor it is a registered insurance company.

Don’t ever copy your friends in insurance, obtain insurance according to your need and requirements.

After taking insurance, if you find the information given by your policy agent is different, you can always cancel the policy with a week.

Therefore you save a little money for yourself.

Remember your loss is someone else profit.

Stay tuned…..