TurboTax is one of the market leader in online tax preparation services. And in 2024, it continues to be the most popular tax software to file your tax returns online. So we are going discuss about one of premier tax software which has the most robust filing experience that we will find in the market.

There are few changes which we are going to see is that the updated tax code and law changes implemented inside of the software.

Some of the biggest changes to look out for is the standard deduction has increased across the board, $900 for married filing jointly and $1,400 for head of households.

The advanced child tax credit has reverted to the standard deduction of 3,600 for 2023 taxes, and the child independent care limits have returned to pre-COVID limits.

And more over, form 1099K will go to a wider number of small business owners including freelancers and the solar energy credit has increased by 30%. if you buy products like solar panels and water heaters And , these are the recent changes you will experience across all the tax software.

Even though it is one of the costliest tax preparation service you will find online , many choose TurboTax for it premium feel and robust service . They do have a free version for limited tax filers, if you have things like a W2 or social security income, bank interest or dividends, a child tax credit, student loan interest deduction, or earned income credit, in those situations, then you could file for free using turbo tax . But for tax filers who have HSAs or child care expenses and unemployment income, would not qualify for the free version and have to use third party slabs.

TurboTax often changes their pricing throughout the tax season, so the best deal is to but it as early as possible. If you know this is the software that you want to go with, lock in your price as early as you can for the best deal.

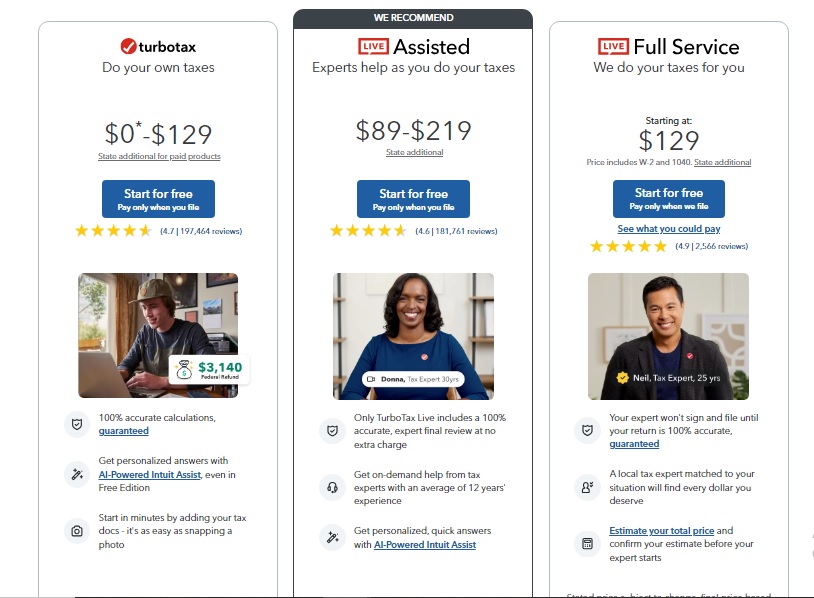

So there’s actually three different options when it comes to filing your taxes with TurboTax. You can DIY, and that’s again with the free tax filing situation as mentioned earlier , or up to $129.

Now the state is additional when you’re paying for your state return through TurboTax is going to charge $39- $64 additional to whatever you’re paying for your federal filing.

You can also opt in for the assisted option where you’re getting help and support from a tax expert and that’s anywhere from $89 to $219 and then of course the state is additional

They offer a full service like you want a tax professional to do it all. If you don’t have a CPA in your area, but you really want to work with one, turbo tax has you covered. So they’ll offer to do their your taxes for you from anywhere from $ 129 depending on your tax filing situation.

If you got multiple things going on, you got a mortgage, investments, you’re a small business owner, you’ve got a W2, everything. then you may want to opt in for somebody who is a professional and knows what they’re doing. Otherwise, if you’ve been doing your taxes for several years and you’ve just been adding some things here and there, the DIY is actually a really robust system and that’s what we’re going to discuss further.

** All these price can change in future , these prices are taken while writing the article .

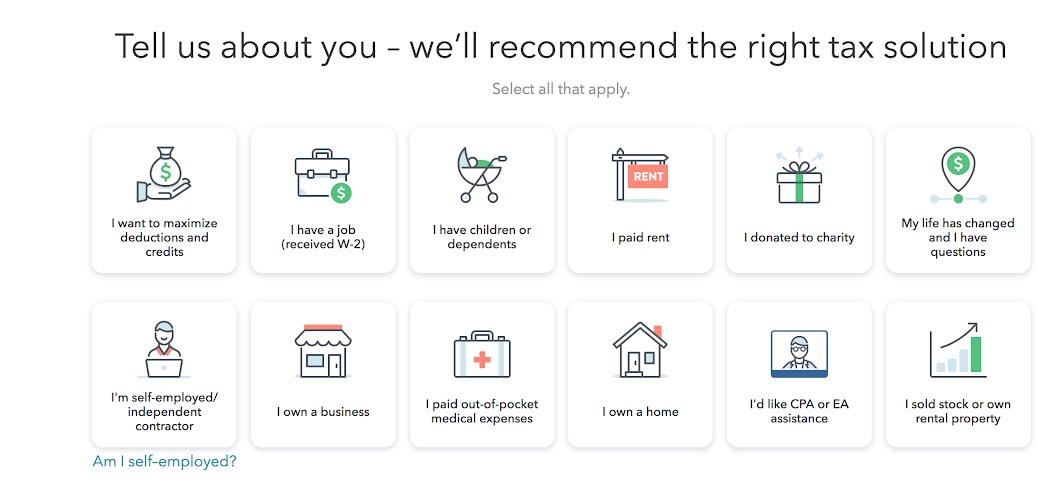

TurboTax comes with a user friendly dashboard, you can see they often just guide you step-by-step with a really quick and easy Q&A guidance.

So here they have these little tiles that show you exactly what are some options that you could have to make sure that all of your tax filing situations are covered. So you can say, I want to maximize deductions and credits. I have a job, received a W2. I have a kid. I’m self-employed. I sold stock crypto on rental property select which ever is applicable.

And , select I’m comfortable doing it on my own. And then they’re going to show you what option is best for you based upon your answers. So let’s get started for free. Then you’re going to fill in your information and get started. Select the appropriate tiles like paid rent, childcare dependents select all that is applicable .

If you have 1099 INT or 1099 DIV forms, all of that is shown and then select if have rental income or a health savings account, then you can quickly add those things.

You can import these forms if you have and avoid typing all the information into the window.

Turbotax also automatically connect to other platforms like Robinhood, Fidelity, Betterment, and import data which can save a lot of time doing it manually. You can just import all the information to TurboTax so it makes the tax filing experience really fast.

All tax software is going to have very similar sections. Like, it’s just the income, deductions and credits, tax filing situations, and then your review, and then you’re off to doing your state taxes after that.

So I love how this is a step by step process. You’re not going through a menu of items, but rather you’re being guided throughout the entire experience. If you’ve done your taxes before and you’ve done it for several years, then you might be used to just picking and choosing which sections of your tax return you want to work on. This is going to kind of push you through this Q&A, so it could take you a little bit longer. If you’re somebody who’s used to doing your taxes on your own, then you may want to consider something like a Tax Hawk or a Free Tax USA where you can pick and choose from those menu items a lot faster and do it for a better price.

TurboTax’s rideshare drivers can actually connect their app to TurboTax and they can download income data for their taxes, which is really incredible. Not only can you do that, but again, if you had any of those 1099 INT forms and you want to connect to outside brokerage accounts or investing accounts, you can seamlessly connect those inside of TurboTax without having to do the whole upload of a PDF document or manually key in entries.

TurboTax is going to be your best tax software and the ability to import your data. So is TurboTax worth it? You are going to be paying a premium cost. So if you are comfortable with paying the higher prices, for a really relaxed experience inside of the tax software, then it’s going to be worth it for you. Most people with complex tax filing situations are going to tell you that the time that they save using TurboTax is worth the cost.

It’s not worth the extra effort to save a dollar or two if you’re spending hours in a tax software that really not helping you complete the task, when it comes to some of those more complex tax filing situations. And you have to look at your own tax filing situation.

If you have a very simple tax filing situation, then you may want to look for something that’s compartively affordable like a Free Tax USA, H&R Block especially if you have those simple forms of just like a W-2, or an HSA or student loan interest form, then you may want to look elsewhere for a cheaper alternative.

Even though it is one of the best online tax filing service it comes with its own disadvantage ,

Yes, TurboTax allow a integration with Coinbase and Coin Ledger where you can import all the data of your transaction to file your crypto investment

TurboTax online software is not offering any specific refund deals. However, certain software packages are advertised on Amazon with cash refunds and gift cards.

Image source : Turbotax