India is going digital with everything, now every one used to digital payment through UPI payments, next big market is UPI-based credit cards. Aspire App is India’s first UPI-based credit card. India has the highest smartphone users in the world, so it is evident that this digital app will make its own way for its new product.

Since every essential outlet has introduced UPI payments, this app would be very useful for people who use UPI payments.

You can download the app from the Google play store, the app is yet to be launched in IOS.

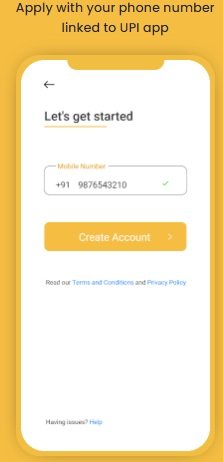

Install the app and register using your mobile number.

Enter your PAN card number, date of birth, the Credit limit you need, and your E-mail address and accept all the terms and conditions, and click on get OTP.

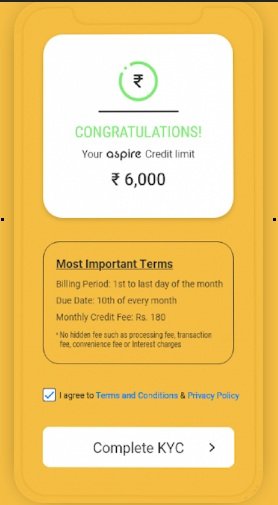

Enter your OTP, address, fill in the questionnaire by Aspire app, and complete your KYC.

Once everything is done all you do is scan and pay your UPI bills and pay them by the due date.

You don’t need an existing credit card to apply for Aspire UPI credit card.

Your credit balance is not based on your credit score.

You can get the line of credit up to Rs 20000 within 5 mins.

You can increase your credit score by paying the bills on time. A good credit score is always good on financial progress card. See why you should use one.

Aspire app provides easy EMI for your purchase, which you can pay in 4 installments.

No hidden or processing charges are other than a monthly fee of Rs 180 for using the service.

You will be liable to pay late payment fees if you forget to pay the credit bill on time. Your credit bill due date is the 10th of every month.

So if you are regularly using UPI payments for your purchase, it’s good to have a digital credit card and pay your purchases at one go without thinking twice.

Stay tuned…