After my plunge into stock trading, I have been trying various stock trading apps to do my tradings. First I started using Kotak securities and then to Zerodha and then to Groww. I have been using all three applications daily to maintain my portfolio and to see which is best suited for me. So after years of usage, I fell comfortable with the Groww app.

Both are discount brokerage firms offering minimal brokerage service. If you see the application process both Zerodha and Groww seem to have the same account opening procedures and KYC. But what differs is the user interface on both, Groww seems to be a nice UI when handling the application. The user interface of Zerodha looks a little clumsy and confusing and getting information on stocks is little challenging. Whereas Groww app has a smooth line of operations.

| Zerodha | Groww | |

| Account opening charges | Rs 200 | Rs 0 |

| Trading account – Yearly charges | Free | Free |

| Demat account opening charges | Free | Free |

| Demat account = Yearly charges | Free | Free |

Brokerage charges on Zerodha for equity delivery is 0 but intraday charges are Rs 20 for an order or 0.03% whichever is lower. Groww charges Rs 20 for equity delivery or 0.05% (whichever is lower) and for futures and options flat Rs 20.

There are other regulatory and statutory charges which are levied by both the application.

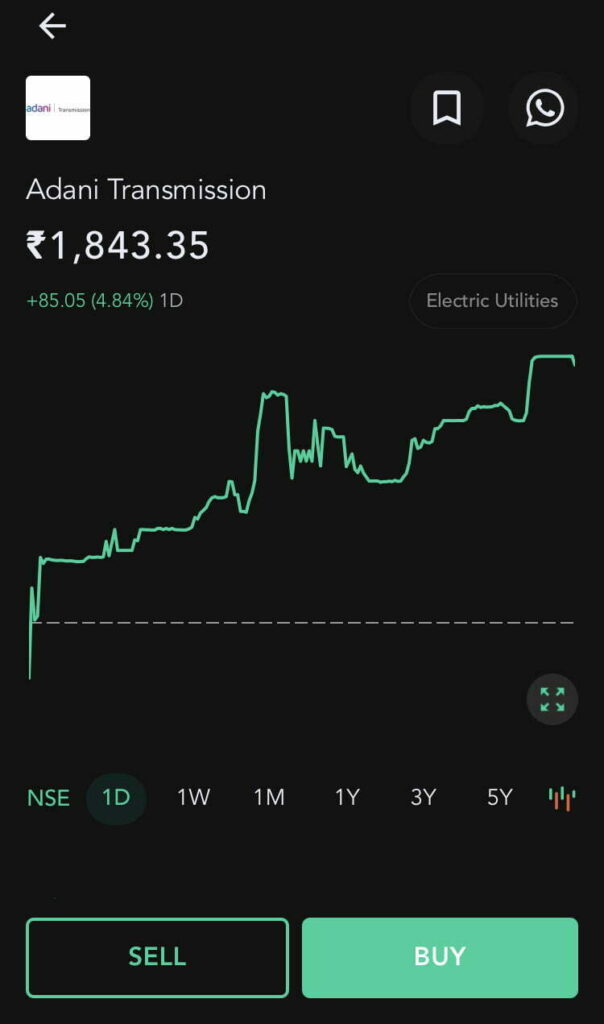

The other advantage of using Groww is the attractive charts and portfolio dashboard which is very user-friendly. Groww also gives the option for registering mutual funds directly showing various portfolios.

In Groww, you can manage both stocks and mutual funds with one click. This is something that made me comfortable using Groww. Like, you can check the progress of both investments in one go.

Getting mutual funds from Groww is an easy peasy thing, all you need to do is transfer the money from a bank or UPI and buy the mutual funds of your needs.

They offer direct mutual funds with 1-5 years duration and SIP on the same.

Groww also gives you advice on various mutual funds according to your needs. The only difference between Groww and Zerodha is Groww seems to be more friendly and not clumsy and anyone can understand the dashboard if they are a smartphone user.

Since Zerodha came much before Groww, it has a huge customer base. But people who have used Groww will know it is one the best stock trading application available in India.

Both the application give rewards if you refer your friends. Since Zerodha gives 300 rewards points and 10% commission on your friend’s brokerage Zerodha seems to have a strong base. Whereas Groww gives flat Rs 100 for both referrer and user, it is a win-win situation for you and your friend. But what Zerodha is offering is a recurring income and Groww offers a one-time benefit.

Both applications are good but I felt more comfortable using Groww.

I hope this application helps you to start your investment journey.

Stay tuned…..