I never knew this term until I started to learn about investments. And trust me it took a few hours of self-study to know about how this actually works. So, in this article, I am trying to break down one of the secure and risk-free types of investment to our common people. Let see how you can invest in government bonds.

When I say bonds? what is the picture you get in your mind? if it is a bunch of papers like agreements? we are good to go. Bonds are nothing but contracts between the lender (you) and the receiver stating how much money you have given and how much money you will get as interest for the amount. Normally the government and central banks issue bonds, which is safe and some are tax-free.

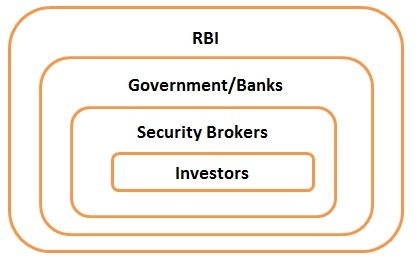

Like any investment option in India, it is controlled by a central body. Here the investment bonds are controlled by RBI and sold to you through various security exchanges and brokers.

So like all other investment options you can buy bonds online using “NSE goBID .

You will have the following options

Choose the type of bonds and the number of bonds then buy and wait for the maturity.

You know your FD for 5 years is like you are giving a loan to your bank for which the bank pays you interest. Likewise, here the government institutions raise money from people for their projects and pay interest for it.

However, these bonds are issued by central and state governments. Unless your government is shady and swallows your money, it is safe and risk-free. So people prefer government bonds to park their money and get a decent interest on it.

Previously bonds were not accessible for common people, it was only available for wealthy persons and for big financial institutions. There was a competitive bidding process to buy bonds issued by the government of India or RBI. Like if one bond is issued for Rs 1000 it used to sell for more price after the bidding according to the interest rate on the returns.

After 2017 RBI made bonds available for the common man. You can buy without a bidding process through a mobile application called “NSE goBID“

Well, it depends on your goal if you have more cash and you just want to protect it, then government bonds are good. That’s the reason high wealthy individuals invest in bonds. They just want their extra cash to be protected and the interest is nothing but a bonus for them,

But for you and me, we need to create wealth so it is better to invest in stocks and mutual funds where the returns are higher than bonds.

If you don’t want to take much risk and happy with 6-7% returns you can invest in tax-free government bonds and sovereign gold bonds.

Even big corporate companies issue bonds, but are they risk-free ?. It all depends on the company. I suggest doing your research before investing in corporate deposits/ bonds. The coupon rate ( Interest rate) may be high but you know the thumb rule, high returns are equal to high risk.

Stay tuned….