Investing in the stock market was a serious business before it became online. Do you remember those long columns of numbers printed in the newspaper under the heading STOCK MARKET? It was all clumsy and number-crunching types that made common people stay out of investing in stocks. But now times have changed, where more people found ways to invest in the stock market.

After making it online, the whole process got simplified and the stock market was accessible with a single click. It is a good choice of passive income where you earn money online by stock trading and dividends.

A stock represents a part of the ownership of a company. Companies sell stocks( a part of shares) in the stock market to raise money to invest and grow. When you purchase a stock, you are purchasing a small portion ( share) of that company and you are a ” Share Holder”. And you will have voting right on resolutions made, having a share of a company won’t make you a part-owner. You are entitled to earn only a share of their profits ( Dividend).

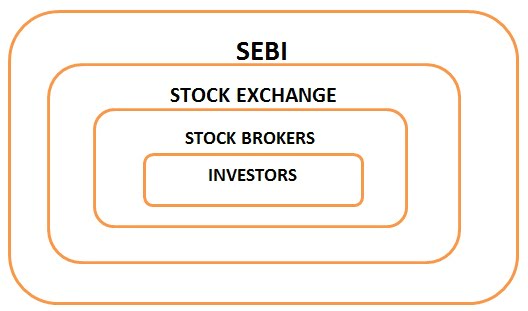

The stock market is controlled by the government regulatory called SEBI. The companies who want to sell their shares on the stock market approach SEBI and get the necessary approval. After the necessary approval, the companies shares comes to the stock exchange for trading (Sell & Buy)

NSE and BSE are the two stock exchanges where most of the shares come for trading, after SEBI’s approval the companies get their identification to start trading. These stock exchange and share markets are controlled by SEBI, it is the policy of the whole stock market.

Stockbrokers like Kotak securities or ICICI direct are the ones who stand between the investors, that is you and me. They are the people who will mediate between the stock exchange and governs all the transactions.

I started with no knowledge of the stock market, my whole aim to invest in stocks was to earn dividends. Trading of stocks was a little risky for me because I was starting with little knowledge, So I advise you the same if you have less knowledge it’s better to stay with stock investment than stock trading.

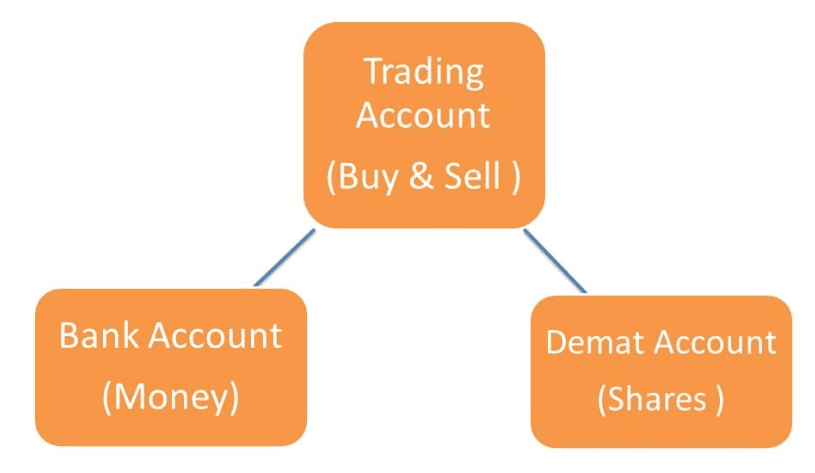

In order to invest in stocks you need

A bank account holds the money required. When you buy shares the money is debited from the bank and when you sell your share the money is credited to your bank account The shares you buy or sell will be accounted on your Demat account.

There are few banks that provide you all three services at once, so you can choose accordingly with their brokerage ( Charges detected when you buy or sell ).

I opted to open with Kotak Securities since I had a bank account with them already. It was pretty easy for me to open a Trading and Demat with few document submissions. ( Which they come and collect, like any bank ) . And their brokerage fees were also flexible. You can download the app and use it handy with good security.

It takes a few weeks to get the account active, meanwhile, you can research the stocks you want to buy. I was concentrated on the company which was good at paying dividends.

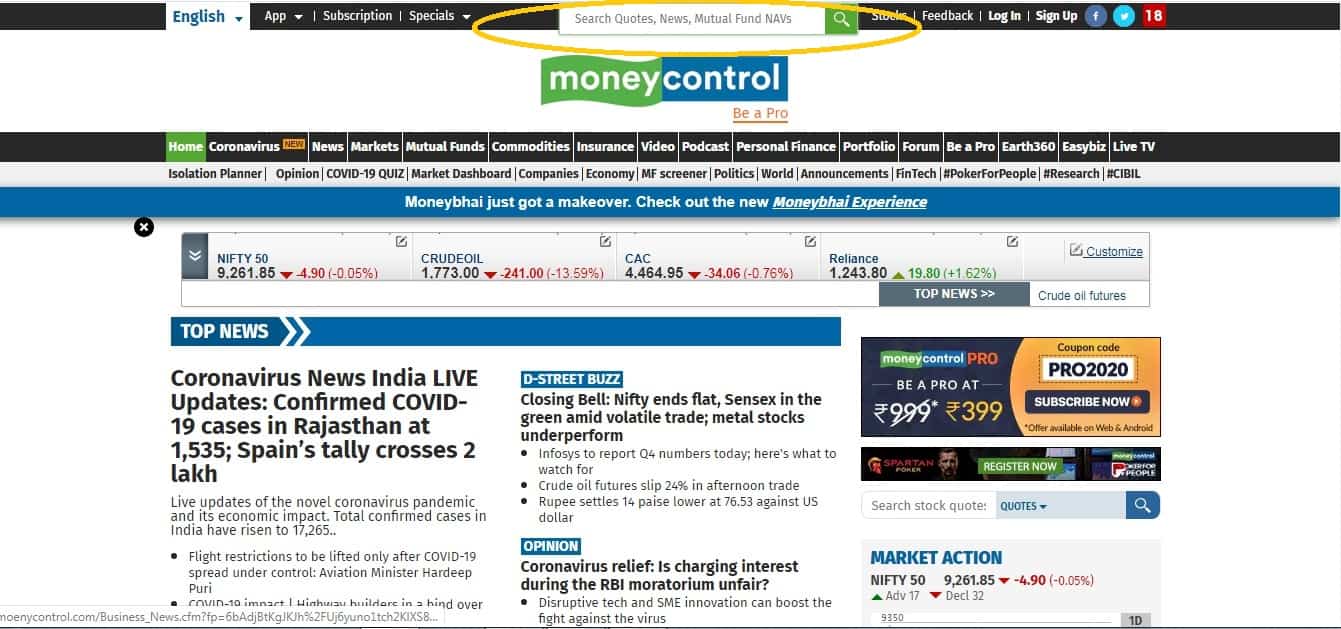

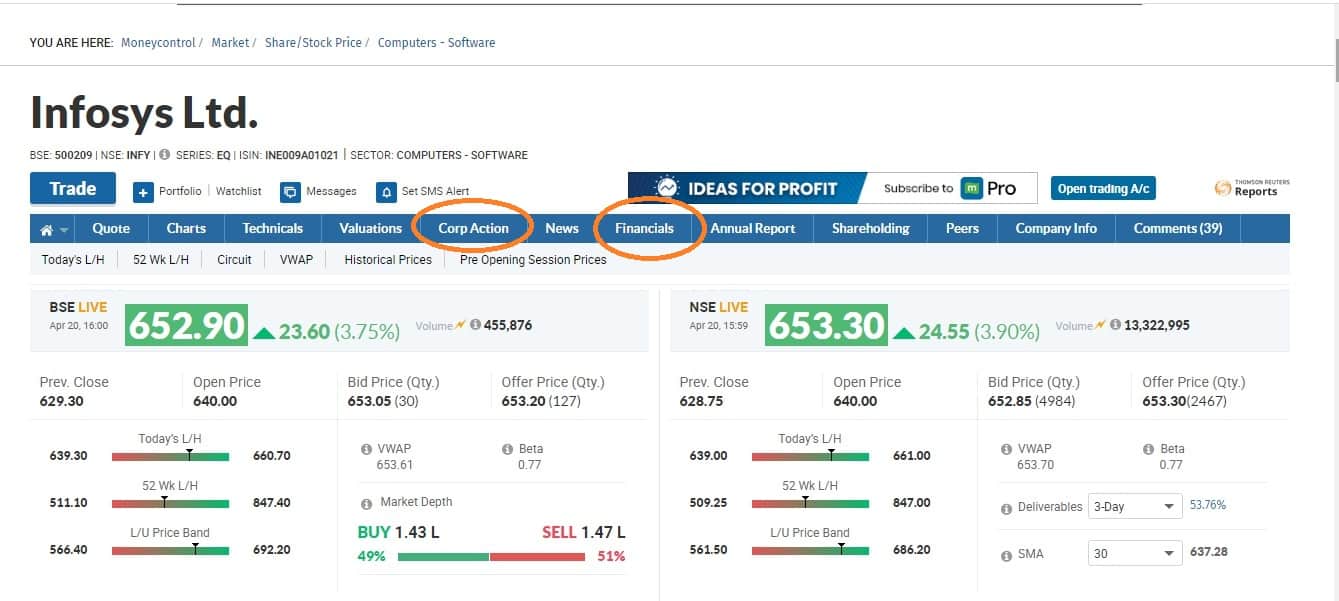

In order to identify a good company, you have to look into their Profit & Loss account. This gives you an idea about how the company is performing financially. To get Profit & Loss account details I use Moneycontrol, which has all the details we need to look at.

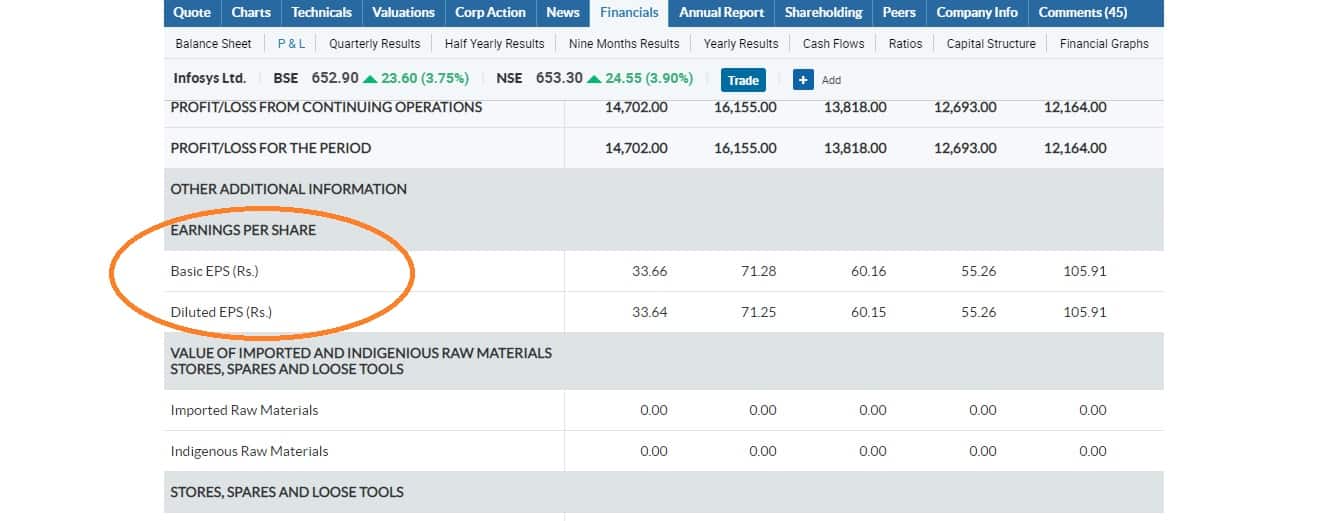

Source : Money control

EPS data gives you information about the company’s profit. And Dividend Data shows if its paying dividends for profits earned.

After Selecting your stock login to your trading account to buy the stock, make a note on the price trend from the quote chart, Buy the stock when it is in the lowest trend,

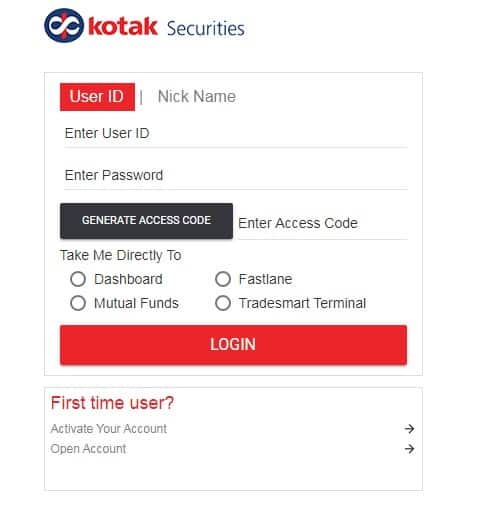

Source: Kotak Securities

Enter your login details and generate access code to enter to the trading account.

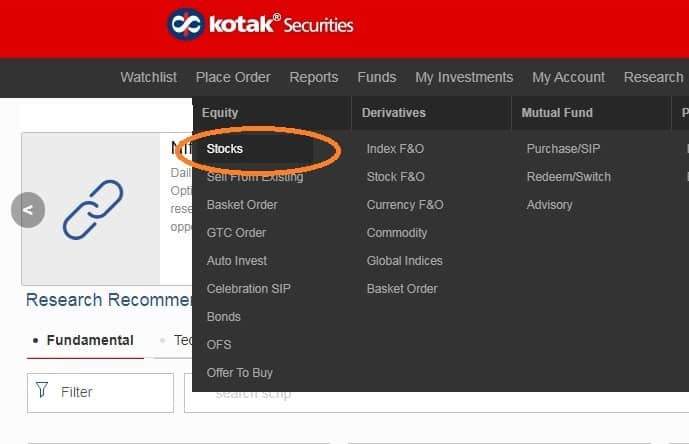

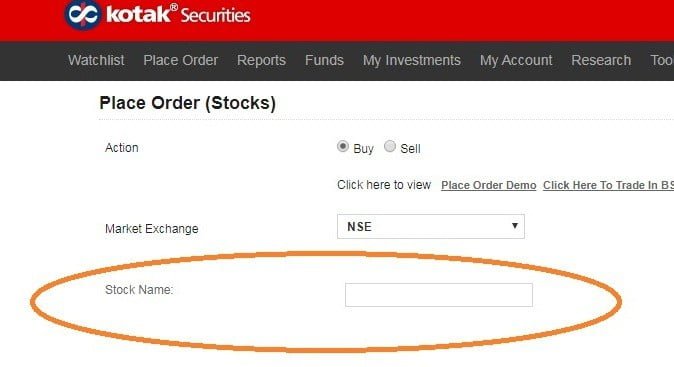

Under place order select stocks.

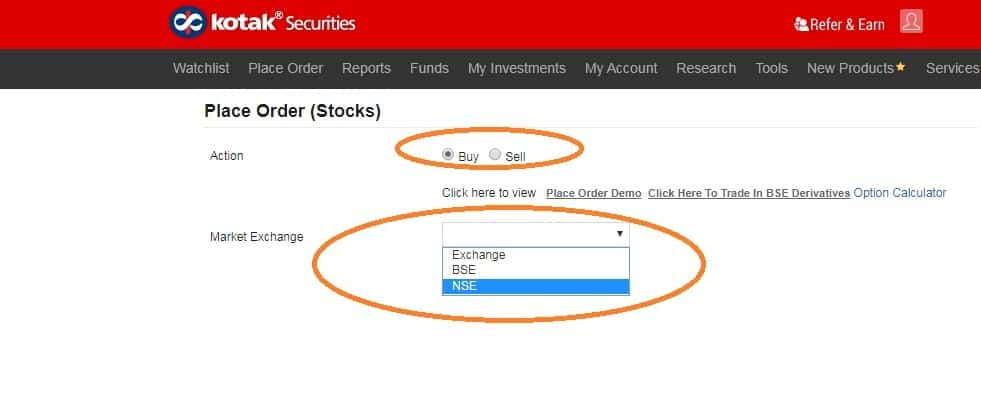

Select BUY and select the Exchange ( BSE or NSE )

Enter the name of the stock you want to BUY

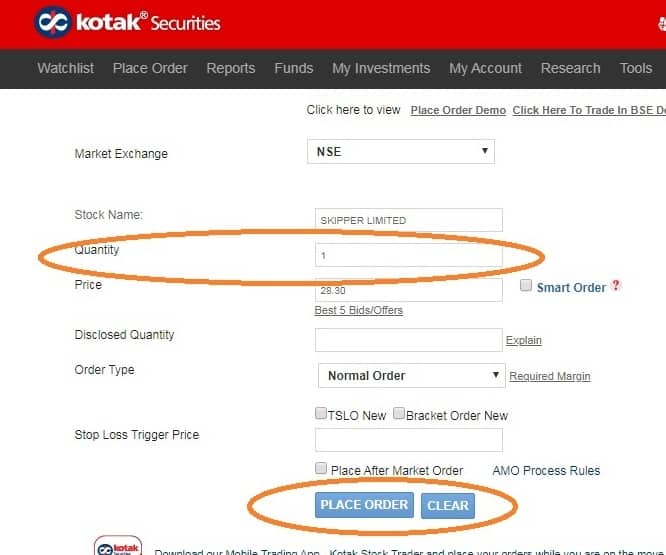

After you give the Quantity then click place order

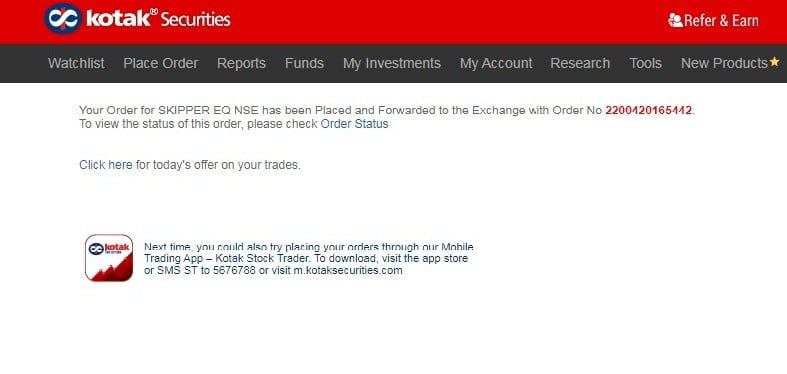

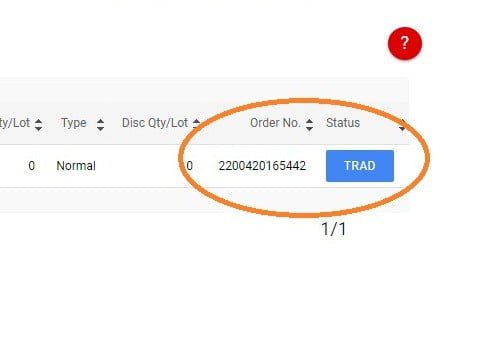

When you click place order you order is placed and order number is generated .

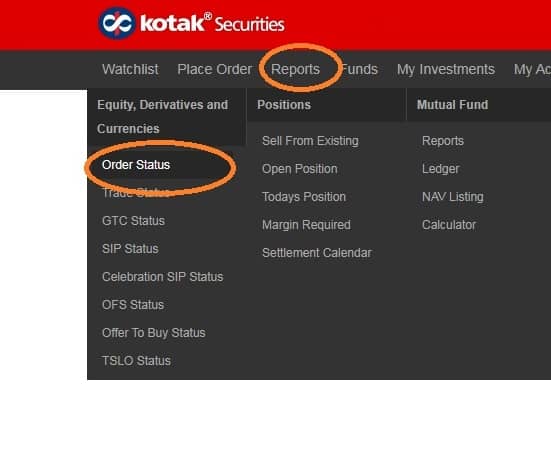

To know the status of your order click the order status under reports tab.

You can see the order status as Traded once you buy the stock, or it will be on OPEN order if the order is yet to be completed.

Investing in stocks is a good way of earning a passive income, I would recommend to start investing a part of your savings to the stock market where your money works for you. It not only grows with time but also generates income. Investing in stocks is better than investing in Fixed deposits for a few reasons.

Fixed Deposit gives fixed interest income, but it never grows whereas dividend income can increase year on year according to the performance of the company and the stock value of the company also keeps increasing. Interest income attracts tax and dividend income is tax-free up to 10 lakhs.

For Example

ITC – April 2011

Share price: Rs.129/share.

If you buy 10 numbers of shares of ITC.

The total cost of Share investment is Rs.1,290.

If you hold the shares say for 5 years, in April 2016.

Share Price: Rs 213/share.

No of shares bought: 10 nos.

Now the share investment became Rs 2130.

So your total investment has increased more than 60% + dividends and share bonus. Investing in good shares will increase the share price year on year.

Investing divined again on dividend-paying stocks will help you to grow your investment. Mr. Rakesh Junjuwala earns 100-150 Cr as dividend income from his investment.

Always check your Dividends from the company, if it’s on decreasing trend or on the increasing trend. Dividend from the company may decrease if EPS is decreasing year on year. As you know EPS measures the company’s performance.

Reading and listening to people who have already been a superstar in the share market is one way of refining your skill. Signup for a class if you are considering it as a serious profession and want to acquire more knowledge of stocks.

Watching the news on the stock market and following updates on your stock gives an idea of the current market trend.

These are the few books I would recommend to horn your skills to invest in stocks

You can also see online courses on stock market trading

Markets are volatile so always check on your investment and keep track of your dividends. Set a goal for yourself on your investment and see that you achieve it. When you are a beginner losses can come, but see that you can handle the losses and learn from your mistakes.

Keep investing And Keep Growing !!!

Stay tuned….