The Internet has made several things easy for us like if you have a smartphone and few dhirams you can make money from where you are, thanks to the smartphone and investment platforms. Earlier investments were a tricky thing that people hesitated to do, but now it’s all in a click of your thumb. If you are in UAE and you want to start investing in stocks, bonds, and mutual funds, Sarwa is the platform that is best suitable.

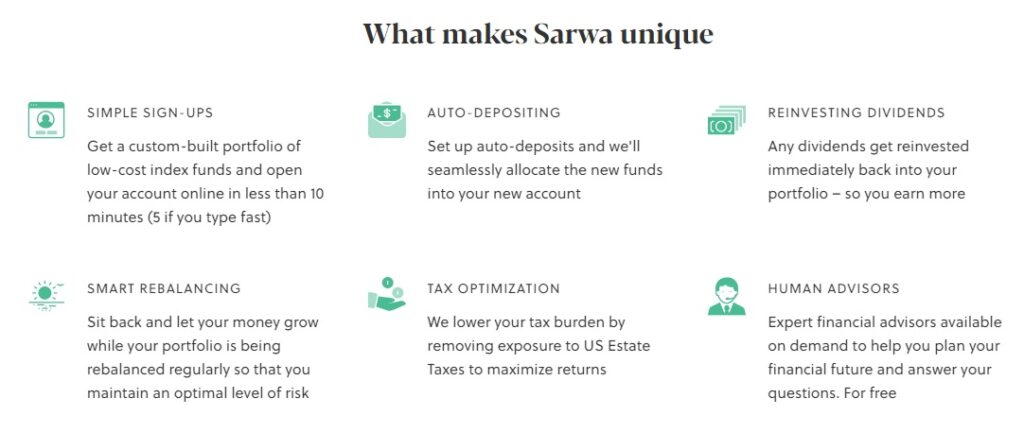

Sarwa is basically an online platform that helps you to invest in small equity funds with low-risk portfolios and trade US stocks. Sarwa chooses the investment based on your requirement, it offers rebalancing, reinvestment of your dividends, and tax optimization.

All these are done freely where you can save enough time letting Sarwa do that for you. All your investment is held by USA based broker firm called interactive brokers and Sarwa is also regulated by Dubai Financial Service Authority, so it is pretty safe investing through Sarwa.

Sarwa focuses on long-term investment by building a portfolio according to your risk appetite.

Let me explain in detail about the inbuilt service they offer on their platform.

Rebalancing: If you choose your risk to be minimum during opting for a portfolio and it turns to a high-risk portfolio due to mark conditions, Sarwa will automatically rebalance your portfolio to stay at your opted risk level.

Dividend Reinvestment: When your investments pay out dividends you can choose to reinvest that money to buy more portfolios. Sarwa does that for you automatically without any charges. If you don’t choose this option, the dividend automatically comes to your registered bank account.

Tax optimization: Sarwa will help you to reduce your tax liability from your investment in the portfolio.

All you have to do is download the application and fill out the questionnaire. The questionnaire is basically to understand your investment interest and the risk you like to take. Once the questionnaire is filled, it chooses your portfolio and will make it ready for investment.

Choose your risk profile carefully, as you know low risk, low returns and high risk comes with high returns. So you should be choosing your right risk appetite, like how much money you can lose.

And, next thing is to upload a few documents and a selfie holding the valid ID, it is all done with your account setup.

Now deposit an initial 500$ to the account which is fully usable for your investment. Depending on your risk options you can start investing in the portfolios. You can invest in all US-listed stocks and ETFs from all exchanges.

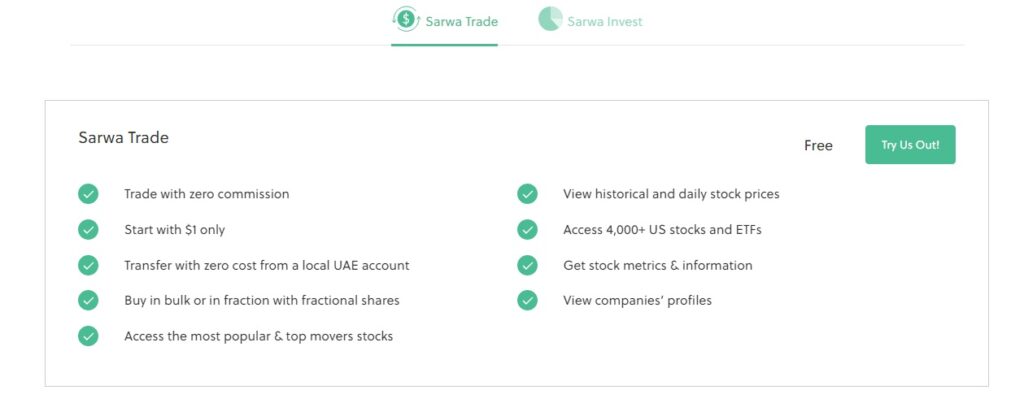

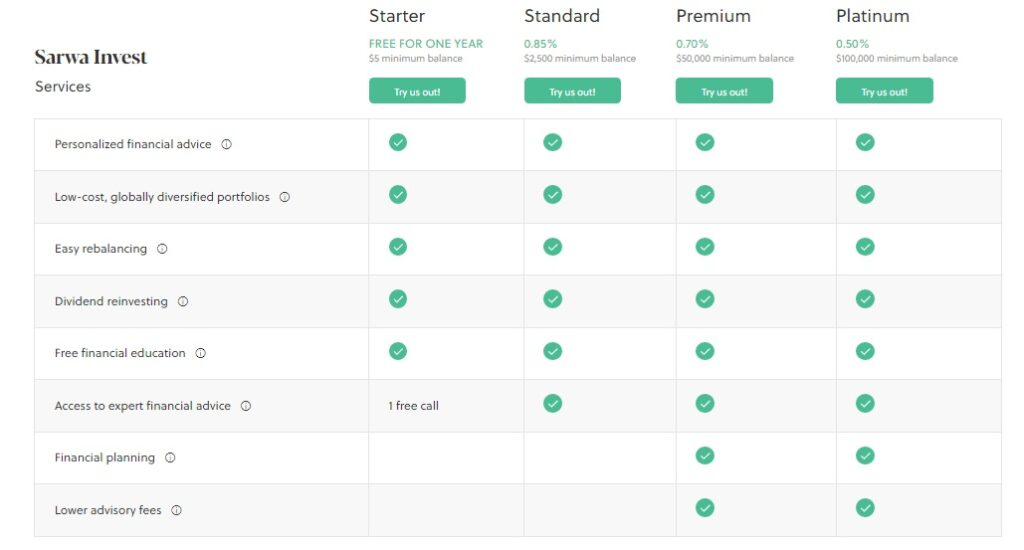

It charges 0% commission on your stock trading and no charges on your bank account transfer. Portfolio investment service charges depend on your investments, it starts from 0.25% per annum. You can also opt for different service packages according to your requirements. Check the pricing here.

Start investing and make your money work for you.

Stay tuned…