I came across this new investment in my Instagram ad. And I was curious to know about it, I did some digging, and signed up to know how it works. Grip invest is an alternative investment module for people looking for investments. If you have already invested in various other modules like stocks, mutual funds, and fixed deposits, GripInvest can be your other wheel of investment.

Grip invest is into lease finance, they rent things to startups and new-age companies and make money on it. Gripinvest pools money from investors( like us ) and use the money to lease things ( IT hardware, vehicles, or office furniture) to companies and generate rental income on it. They do all the acquisition of assets, rent them to companies with proper agreements, collect the lease amount and give a part of this amount to investors as returns.

It is basically rental income but not on properties but on movable assets. All new companies prefer to lease things rather than own them because they don’t want to invest a large chunk of their money into fixed assets. And that way they can have money for operations and pay for only what they use.

Once you Signup and give all the necessary details you will get to see this.

In the assets section, Grip invest will onboard their partners ( Lessee) who want to lease things for their office setup. After all background checks and document preparation Grip will onboard the partner and put it on their dashboard.

Then a budget is created for it and listed on the site for pooling in money from investors with a target budget.

Once the targeted amount is collected from multiple investors, GripInvest will procure the items for the company and lease them.

You will start receiving your monthly return on your investment from the day you invest, you don’t need to wait till the targeted budget gets achieved.

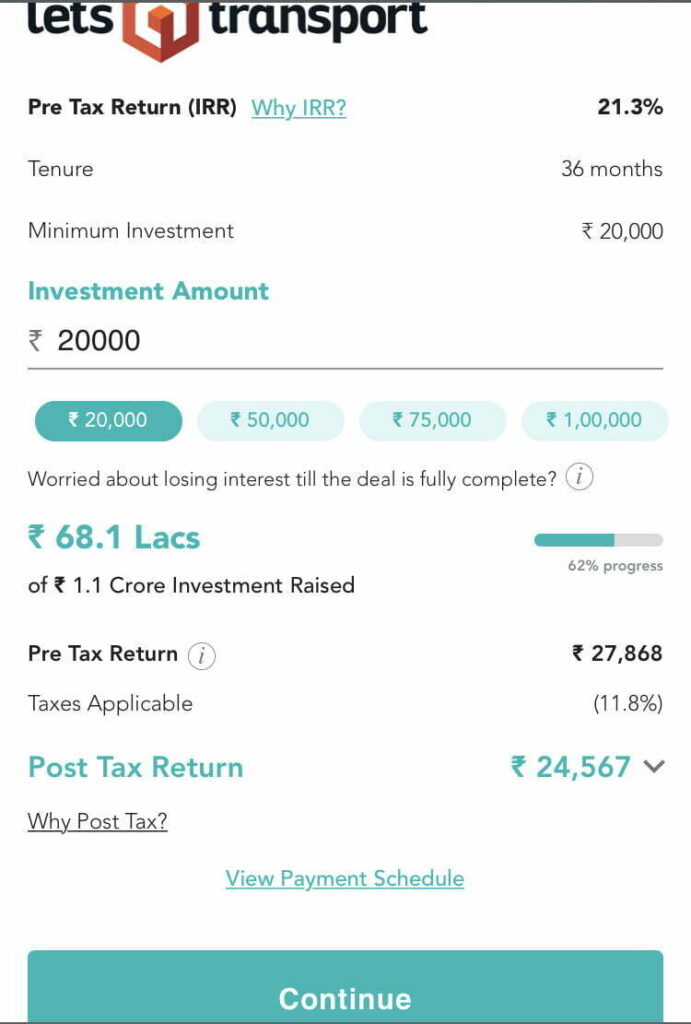

So once you select the company you would like to invest you will see the necessary details like the budget, minimum investment, and rate of returns.

If you click scroll for details, you will get to see the details of assets, returns, and lease terms.

If you are interested to invest in this company’s asset, you can calculate the returns for your investments.

So, if you invest a minimum of Rs 20,000 for 36 months you will have returns of Rs 24567 at the end of three years.

Gripinvest calculates their investments on IRR which is a little misleading for people like us.

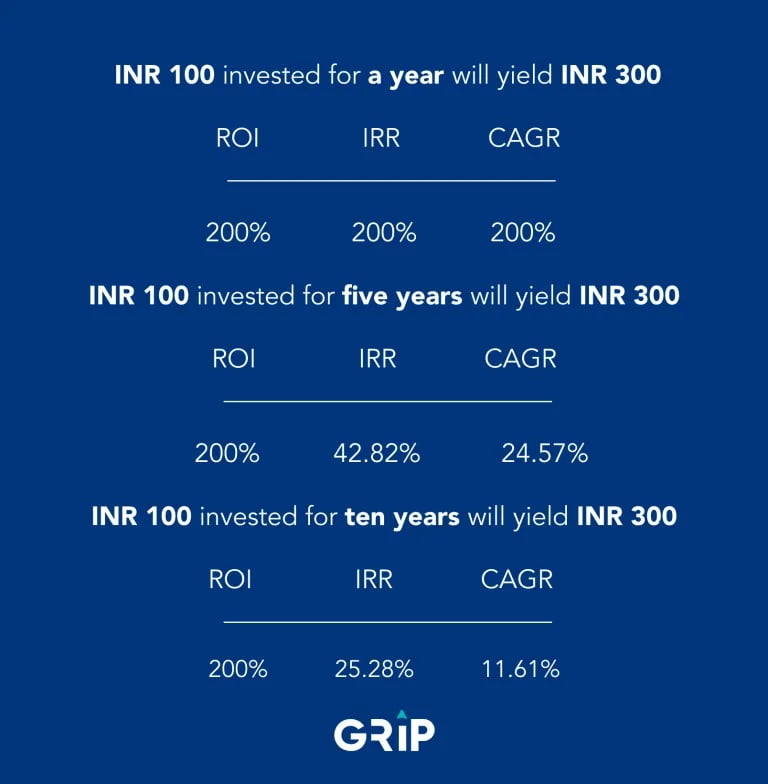

IRR- Internal Rate of Return.

This term is used by investors, it is nothing but a calculation of your returns.

In layman language, it is a calculation that shows, in how many months your actual investments will come back to you.

Like if you invest Rs 20000 to a company to a company, how much time it will take to give back your Rs 20000 (investment).

Grip Invest pays your investment back monthly, unlike FD’s where your funds are kept for years before giving the returns.

Forget IRR % for the returns, if you see by normal FD standards Gripinvest gives a return close to 7% which is more than the current FD rates.

But this investment method comes with a risk, what if the company you invest in becomes bankrupt ??. Well, then they say that they will sell all the assets and repay the investors. This seems to be a little risky.

Is it worth taking this risk for 7% well that’s your call. I would be still happy with mutual funds and some stock trading.

But instead of parking your money in FD, you can try to invest a small amount on Gripinvest because the % of returns seems to be better than FD. And they also pay monthly.

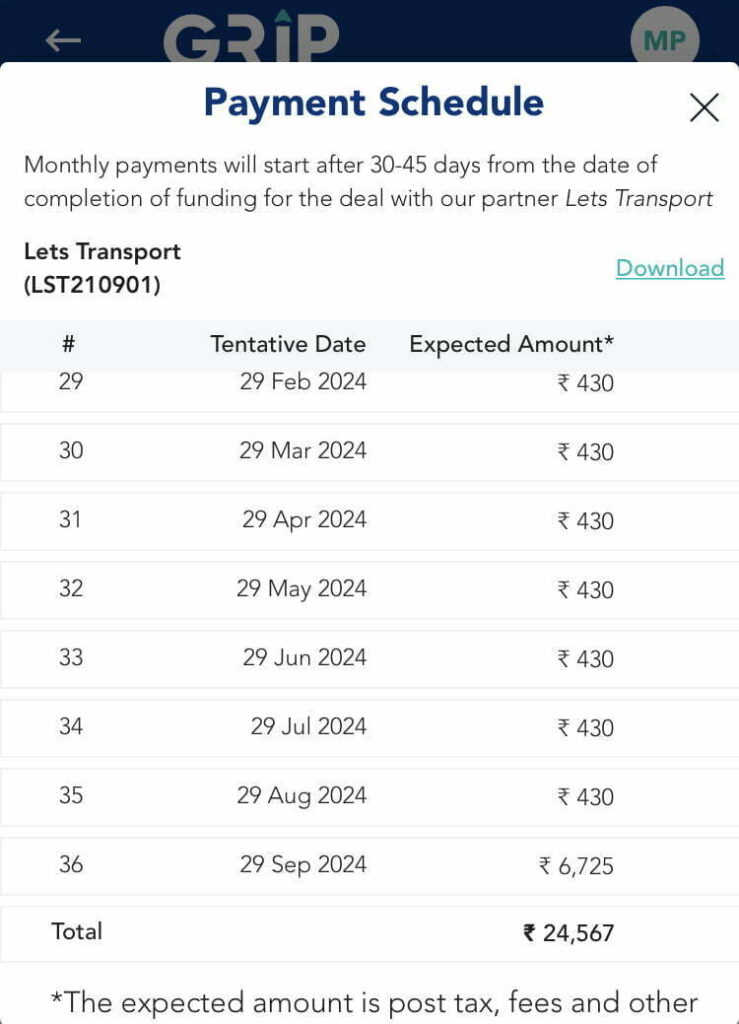

You can check your monthly return schedule before you invest in any of the portfolios.

Go through the company before you invest, it is the fundamental procedure we do before any investment.

If you see as one advantage is your monthly returns, and one thing to be noted is, you cannot take your investment in the middle of the month. Your investment is locked for a specific period.

If you are really looking for an alternative investment other than your stocks and Fd’s this can be an option you can try.

Image Source : Grip Invest